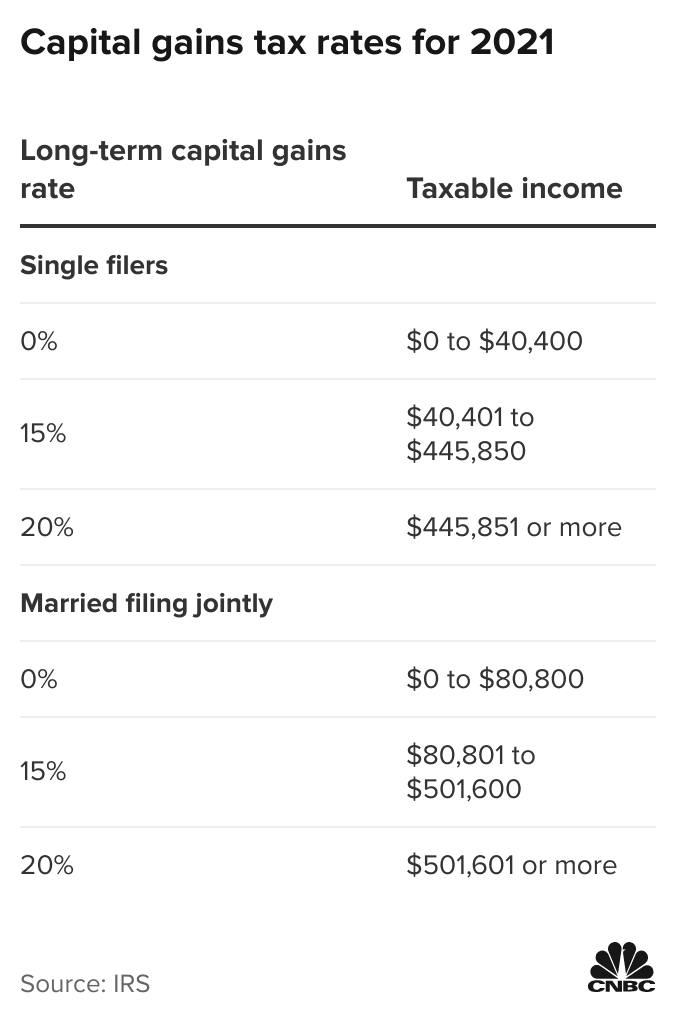

For 2023, single filers making up to $44,625 receive the 0% rate. In addition, you’re a single filer, putting a portion of your income in the 24% tax bracket.Ĭonversely, long-term capital gains have different tax rates than short-term gains: 0%, 15%, and 20%, depending on your income level and filing status. The sale results in a short-term capital gain, and your income is $115,000 when you file taxes. You sell an investment property nine months after purchasing it and make a $30,000 profit. Your income determines your capital gains tax rates.įor example, say you make $85,000 from your day job. The IRS taxes short-term capital gains as standard income, meaning your income tax bracket will determine your tax rate. So, if you sell an investment property, the time you owned it before selling it will determine what kind of capital gains taxes you pay. On the other hand, long-term capital gains come from selling assets after holding them for a year or more. Short-term capital gains are from selling assets you’ve held for less than a year. You can incur two types of capital gains taxes: short-term and long-term. You pay capital gains taxes when you profit from selling assets.

#Capital gains tax brackets single how to

We’ll explain short-term and long-term capital gains and how to keep the associated taxes from costing you an arm and a leg.Ī financial advisor can help you tax-optimize your investment portfolio. Although the IRS taxes short-term and long-term gains differently, you can combat high tax rates on both. Fortunately, you can implement tactics that reduce capital gains taxes so you can keep more of your money. However, they can also incur capital gains taxes that weaken your profits. Real estate investments can be lucrative assets. SmartAsset: Capital gains tax on real estate investment property

0 kommentar(er)

0 kommentar(er)